Try a 10 Day No Spend Challenge & See Amazing Results!

Do you need to save some money this year? Who doesn’t!

Whether you need to pay off debt, keep up with bills or save for an exciting future adventure saving money is never a bad thing.

But sometimes it seems like making ends meet is all that you can do. Especially right now with all the rising inflation on basic goods.

That is why now is the perfect time to try the no spend challenge. Can you save money with 10 no-spend days a month? I know you can!

What Is the No Spend Challenge?

Have you ever heard of the no-spend challenge?

When you try a no spend challenge you are choosing a week or a month in which you will not spend any money on things that aren’t your basic necessities like groceries and bills. It’s a great way to save money fast.

A no spend challenge is also an awesome opportunity to observe how you spend your money and what you waste it on! It’s a great way to reset the way you spend money so that you can develop smart spending habits!

How Can I Make Saving a Habit?

But what if that sounds too hard? You may wonder how can I force myself to save money every month? How can I help my family save money too?

The answer is you are going to have to change some of your habits. You are going to have to plan to save money as a family.

Instead of doing a no spend challenge for a month or a week, you can make it a habit to spend no money at all (even on groceries) for a few days a month.

The easiest way you can do this, and make saving money fun for everyone is to try to have 10 no-spend days per person every single month.

Instead of saving money for one month or one week you will start saving money EVERY DAY!

Step 1: Talk To Your Family About The No Spend Challenge

If you are trying to create healthy spending habits as a family you are going to need to communicate that.

When I first started trying to do 10 no spend days I figured I was the one doing most of the purchasing so I would just track my own efforts.

It wasn’t so hard not to grab that extra coffee or swing by Target and I would come home at the end of the day ready to put a star on my planner.

But then my husband would come home with some snacks he swung by the store for and my star would disappear.

I learned two things from that.

- Your no spend days don’t have to be the same days as your family member’s no-spend days.

- You need to communicate your goals with your family so that they try to pursue their own no-spend days.

Tell your family why you want to save money and ask them to join you in the no spend challenge!

Not spending money for 10 days in a month isn’t really hard. It’s more like a game!

Step 2: Get a Calendar

The second thing you will need to do to succeed in your no spend challenge each month is to have a calendar where you can all track your no-spend days.

You might have to get stickers too so that each family member then put a sticker on the day they didn’t spend money. Or you can just write your initials.

Before you get started, look at the calendar or planner and think about what days might be the easiest days to not spend anything.

I found it easiest not to spend money on my work days because I just went to work and went home.

You may find that the days that are easiest to not spend money are on your work days too. Or you may find that Sunday is a day when you don’t need to go anywhere or spend any money.

Take a minute and look at this with your family.

Your no spend days don’t have to be certain days of the week but it definitely helps to know what days might be the easiest days to go for it.

Step 3: Prepare for Your No-Spend Days

No spend days aren’t going to happen out of the blue for most of us. We go along thinking we haven’t spent any money in a few days until we really stop to think about it.

You placed an Amazon order yesterday and got gas the day before that.

Then you went through the drive-through for lunch and you bought groceries too!

You spend money on little things almost every day without even noticing. But that’s exactly the reason that saving money every day is possible.

If you are going to manage to have 10 no spend days a month you are going to have to plan ahead.

Here are some things you can do to help you succeed:

- Have stuff you can pack for lunch.

- Set your thermos out by your coffee mug so you can take your coffee with you instead of swinging by Starbucks.

- Get gas and your groceries on the same day.

- Put off that Amazon order.

Think about the little things you spend money on daily and try to prepare to not spend money on those things if at all possible.

After all, all those little purchases add up to nothing in your savings account! And you can’t have healthy spending habits it you don’t even know what you spend money on.

Step 4: Remember Your No Spend Challenge

So now you are ready! You packed your lunch and you have your coffee! Dinner is planned and your groceries are already in the fridge. Good job!

Now comes the hardest part. You have to remember all day that you aren’t spending ANY money today.

It can be trickier than you think. One day I was about to put a star on my calendar when I remembered a snack I had bought.

But if you remember that you are not spending money today you can put a star on your calendar at the end of the day!

Once in a great while, you may go a whole day without spending money accidentally. That’s always cool! It will happen more often as you get in the habit. It’s a lot easier if you stay home.

Step 5: Check Your Progress

Every week you and your family can take a quick look at the calendar and see how well everyone did. To stay on track each person should have at 2-3 no spend days a week.

This is not the time to guilt-trip anyone. You are just here to keep track of your no-spend days so that you know what you are aiming for the rest of the month.

Step 6: Take Note of Challenges.

No spend days will probably be easier than expected in some ways and more challenging in other ways.

That’s why they are so great! They show you how you spend money and force you to be more intentional and careful as you create smart spending habits.

If you find that you are struggling with a specific spending trigger, like coffee or Amazon or lunch take note of it and see how you might be able to adjust.

Remember too, you are only doing 10 no spend days a month so if something comes up and you have to buy something on a day you planned not to spend anything, it’s ok. You have more chances to have no spend days all month!

Step 7: See Your No Spend Challenge Pay Off!

A challenge is no fun unless you stop and recognize your success. At the end of the month, when all of you have gotten 10 no spend days stop and give each other high-fives!

Just think about all the money you saved this month! It may be hard to quantify but I guarantee you will save money if you are all being more intentional about how you spend or don’t spend it!

Here are some examples:

- 10 Starbucks Drinks = $40

- 10 Drive-through lunches =$70

- 10 Take-home dinners $150

- 10 Junk food snack grabs = $50

- 10 averted Amazon orders = possibly $100

- 10 times you didn’t go for a Target Run possible $300

These of course are modest estimates, and only for one person. Imagine if everyone in your family did this? Developing healthy spending habits as a family can really pay off!

Whatever it is you didn’t buy on your no-spend days you will save money. Eventually, you will see the benefits of your spend challenge.

Money will start stacking up in savings! Remember your savings goals and keep up the good work while you build healthy spending habits and simplify your life!

Do you think you could try a no spend challenge for just 10 days each month? Have you tried any similar challenges to save money? What do you find yourself splurging on more often than you would like? Please share in the comments below!

Start Living Like A Minimalist Today!

I know you want a happy simple life and there is really no reason not to start enjoying simple living!

Now is the time to try the minimalist lifestyle! Learn why minimalism is good for your mental health and relationships, how it can transform your finances, so you can start having more energy and time for the things that matter!

But what if simplifying your life sounds like an overwhelming task?

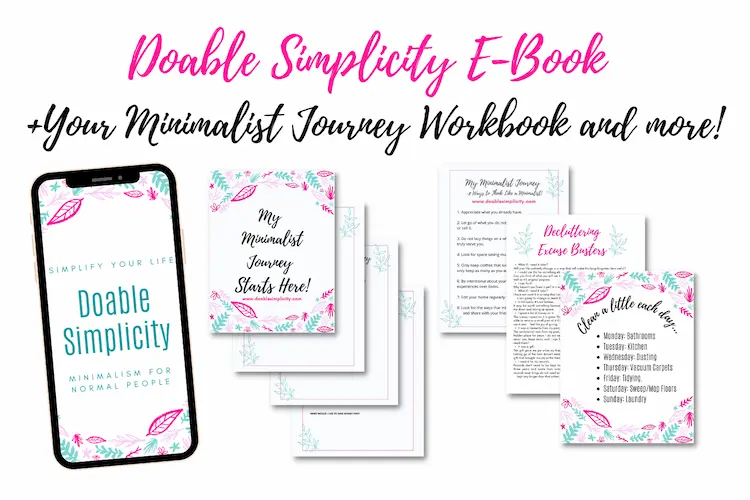

If you want to simplify your life but the big bad word MINIMALISM scares you let me help! I wrote Doable Simplicity (Minimalism For Normal People) to help you get the inspiration you need to simplify your life and then take solid steps that make simple living doable for you!